A Fintech Case Study

The process of appraising software entails navigating a complex landscape, replete with diverse methodologies aimed at discerning its economic value. One notably illuminating approach is the Cost of Replication method, which articulates the software’s value by approximating the expense of recreating it from the ground up. This methodology is firmly rooted in the economic principle of substitution, asserting that the utmost value of an asset is intricately linked to the cost of an equally appealing substitute.

When calculating the value of software, several key elements must be considered:

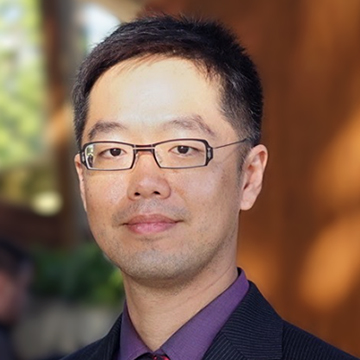

1. Development Costs:

This includes the expenses related to designing, coding, testing, and deploying the software. It is typically quantified by the following formula:

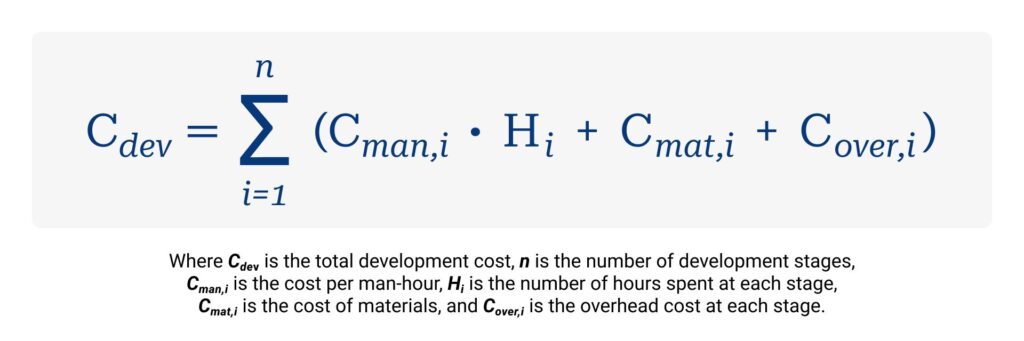

2. Opportunity Cost of Capital:

Given that the development process spans over time, the opportunity cost of capital must be included, accounting for the time value of money. This is often calculated using Net Present Value (NPV) calculations:

3. Intellectual Property and Licensing Costs:

These are costs associated with protecting the software through patents or purchasing licenses for third-party components. They can be represented as a lump sum or an ongoing cost, depending on the licensing agreement.

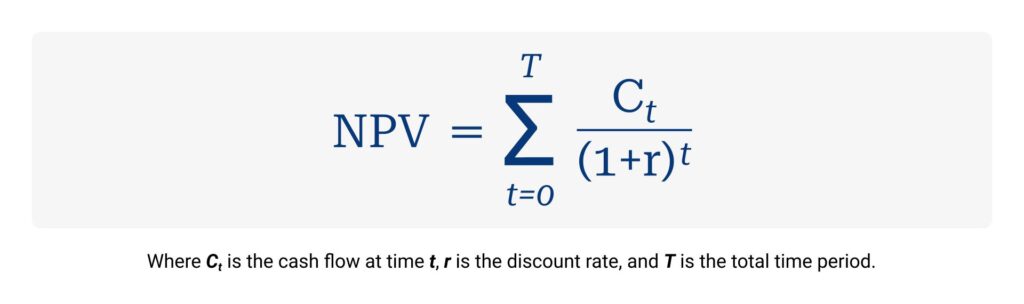

4. Maintenance and Support Costs:

Post-deployment costs such as updates, bug fixes, and customer support are also factored in, often modeled as a percentage of the development cost per annum:

5. Market Adaptation Costs:

These costs arise from the need to adapt the software to various markets, which may include localization, compliance with local regulations, and customization.

6. Risk Adjustment:

Software development carries inherent risks, including technical feasibility, market acceptance, and regulatory risks. These are accounted for by adjusting the discount rate upwards.

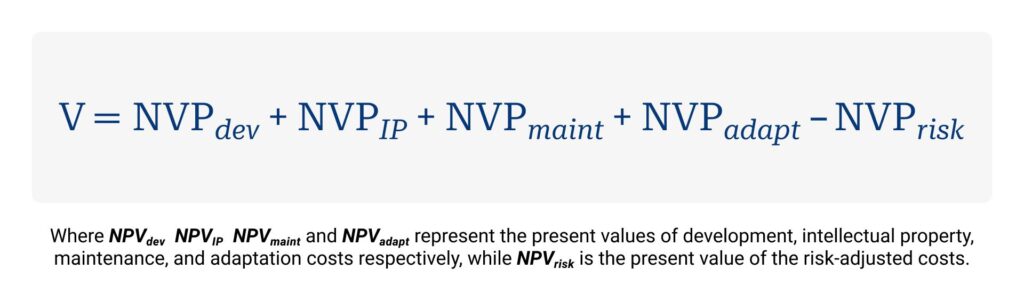

Combining these elements, the formula to estimate the software value V using the Cost of Replication approach can be expressed as:

In the realm of technical analysis, a thorough exploration necessitates a consideration of the nuanced facets of software architecture, the scalability inherent in the codebase, the efficiency of the development process, and the potential for technology obsolescence. These variables collectively exert influence on the intricate valuation landscape.

In conclusion, while the Cost of Replication approach provides a logically structured framework for software valuation, its successful application demands a profound comprehension of both the intricacies of software development and the nuances of financial modeling. Each valuation element mandates meticulous calculation and rigorous justification, rendering the process not only complex but also inherently technical in nature.

Software Valuation Case Study: FinTechPro

At Quandary Peak Research, our computational prowess and vast experience extend across an expansive spectrum of software valuation projects, encompassing various domains and scales. We’ve had the privilege of immersing ourselves in a multitude of industries, leveraging our specialized knowledge to rigorously assess the value of a myriad of software applications. Each project serves as a unique computational exploration, dissecting various facets of software architecture, technology stacks, and the intricate dynamics of the market.

In the subsequent section, we present a meticulously engineered case study derived from a recent project. This comprehensive study has been carefully curated to uphold the paramount principles of confidentiality and privacy for all involved stakeholders. Specific details and configurations that could potentially unveil proprietary or sensitive information have been systematically eradicated.

Despite these necessary data omissions, the case study stands as a computational testament, providing a foundational understanding of the intricate valuation process. It furnishes invaluable insights into our computational methodologies and the multifaceted considerations inherent in the valuation of a software project. This study serves as an unyielding affirmation of our commitment, not only to delivering computational excellence in valuation services but also to maintaining the highest standards of privacy and discretion in all computational endeavors.

Overview of FinTechPro

- Development Stage: The software took 3 years to develop, with a team of 20 engineers.

- Features: Advanced analytics, AI-driven investment advice, secure transactions, and user-friendly interface.

- Market: Targeted at both individual consumers and small to mid-sized financial institutions.

Valuation Process

1. Development Costs

Man-Hour Costs: Average cost per man-hour was $50.

Total Hours: Approximately 120,000 man-hours (20 engineers × 40 hours/week × 150 weeks).

Material Costs: Cloud services, development tools, and other resources amounted to $500,000.

Overhead Costs: Office space, utilities, and other indirect costs were about $300,000.

Calculating the development costs:

Cdev = Σ (50 × 120,000 + 500,000 + 300,000) = $6,500,000

2. Opportunity Cost of Capital

Discount Rate: Assuming a discount rate of 7% for the tech sector.

Time Period: 3 years of development.

Applying NPV for development costs:

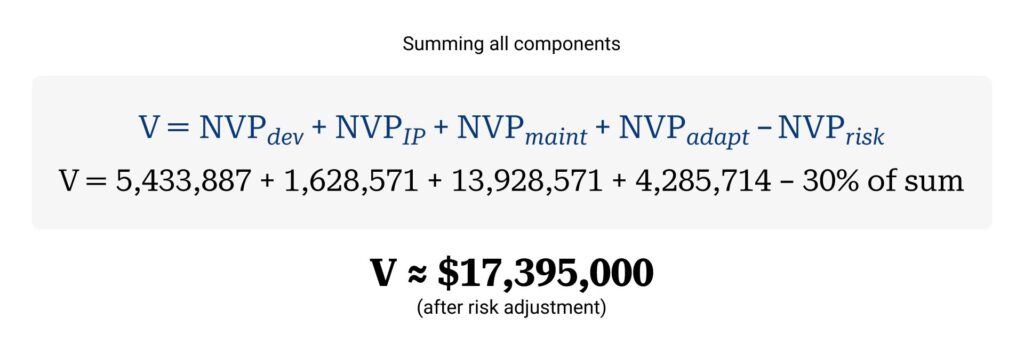

NPVdev = 6,500,000 / (1 + 0.07)³ ≈ $5,433,887

3. Intellectual Property and Licensing Costs

Patents and Licenses: The software required $200,000 for patents and $100,000 annually for third-party licenses.

Calculating NPV for IP costs:

NPVIP = 200,000 + 100,000 / 0.07 ≈ $1,628,571

4. Maintenance and Support Costs

Annual Maintenance Percentage: Estimated at 15% of the development cost.

Cmaint = 6,500,000 × 0.15 = $975,000 per annum

Applying NPV for maintenance costs:

NPVmaint = 975,000 / 0.07 ≈ $13,928,571

5. Market Adaptation Costs

Localization and Compliance: Estimated at $300,000.

NPVadapt = 300,000 / 0.07 ≈ $4,285,714

6. Risk Adjustment

Increased Discount Rate: Due to high market volatility, increase the discount rate to 10%.

Adjusting the total NPV for risk:

NPVrisk = NPVtotal × (1 – 0.10 / 0.07) ≈ -30% of NPVtotal

Final Valuation

Conclusion

The valuation of FinTechPro using the Cost of Replication method suggests a value of approximately $17.4 million. This value takes into account the comprehensive costs of developing, maintaining, and adapting the software, adjusted for the risk inherent in the FinTech sector.

Considerations and Limitations

Market Dynamics: The FinTech industry is rapidly evolving, which might affect the relevance and competitiveness of the software.

Technological Advancements: New technologies could render some features of FinTechPro obsolete, impacting its future profitability and valuation.

Regulatory Changes: Being in the financial sector, regulatory changes could significantly impact operational costs.

The case of FinTechPro demonstrates the multifaceted nature of software valuation and the importance of considering various factors that influence the final valuation figure.