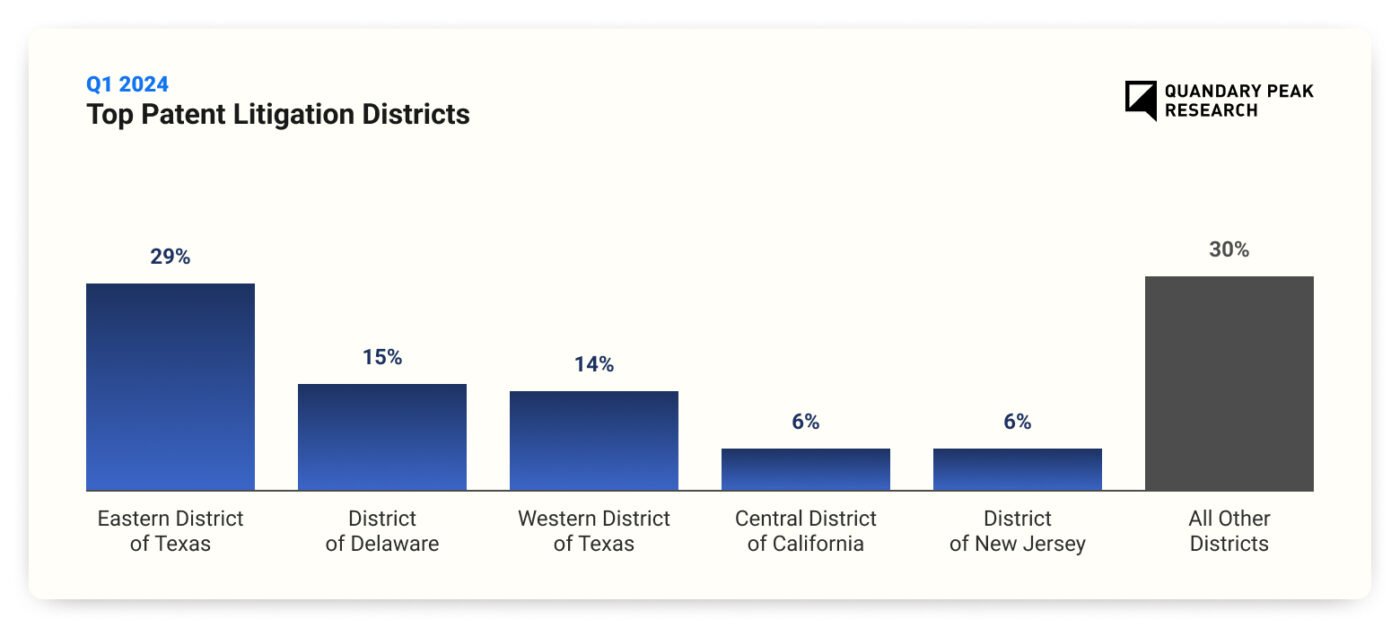

The Eastern District of Texas remains the top venue for software patent litigation. According to a report published by RPX Corporation—a patent risk management company—the district handled 29% of all patent lawsuits filed in the first quarter of 2024, followed by Delaware (15%) and the Western District of Texas (14%). The Eastern District of Texas has held its top ranking since mid-last year. The report also emphasizes an overall increase in patent filings by nonpracticing entities (NPEs) in early 2024, specifically in a market sector labeled E-commerce and Software, as well as a decline in patent litigation activity in Delaware and the Western District of Texas. Litigants should be aware of these trends in order to strategically navigate the evolving patent landscape. A summary of key highlights from the report are explained in more detail below.

This news reflects our recent case history at Quandary Peak, as we have become increasingly engaged in software patent litigation in Texas. In the past year, we have consulted more than 20 patent cases in Texas, representing plaintiffs and defendants. Notably, our software experts served in the following cases that were filed in the Eastern District of Texas:

- Polaris PowerLED Technologies, LLC v. Samsung Electronics America | 2023

- Touchstream Technologies, Inc v. Charter Communications, Inc | 2023

- Touchstream Technologies, Inc v. Comcast Cable Communications, LLC | 2023

- Multimodal Media LLC v. ZTE Corporation | 2023

- Multimodal Media LLC v. Guangdong OPPO Mobile Telecomm. Corp., Ltd. | 2023

- Taasera Licensing, LLC v. Trend Micro, Check Point Software, Palo Alto Networks | 2023

- Entangled Media, LLC v. Dropbox, Inc. | 2023

- HowLink Global LLC v. Verizon, Corp.; ATT Corp. | 2023

- Daingean Technologies Ltd. v. AT&T Inc, et al | 2023

- Lexos Media IP, LLC v. Northern Tool & Equipment Company, Inc | 2023

- Wildseed Mobile, LLC v. Google LLC | 2023

- MyPort, Inc v. Samsung Electronics Co., Ltd. | 2022

- Via Transportation, Inc v. RideCo Inc | 2022

And, these cases filed in the Western District of Texas also relied on our experts:

- Smart Mobile Technologies, LLC v. Samsung Electronics Co. Ltd | 2023

- Entangled Media, LLC v. Dropbox, Inc | 2023 | WD of Texas

- Cutting Edge Vision, LLC v. TCL Technology Group Corporation, et al. | 2023

- Wildseed Mobile v. Google LLC | 2023

- WSOU v. Google | 2023

- AlmondNet Inc v. Amazon.com Inc | 2023 | $122M Jury Verdict

- Best Ring, LLC v. Ronin POS, LLC | 2023

At Quandary Peak, we have a distinct advantage in advising litigants in Texas because we have offices located in Austin staffed by code reviewers and expert testifiers who specialize in providing analysis of software patent matters. Our core team in Austin is comprised of Vikas Sharma, Director of Patent Services, an intellectual property specialist with more than 15 years in source code review, patent portfolio analysis, and monetizing client patent portfolios; Gordon MacKay, Principal Software Consultant, a software and systems expert with 25 years experience, skilled in security analysis, software architecture, and code review; and Software Consultants Josh Mathew and Luis Padilla who provide a range of services including source-code discovery and analysis for patent cases.

Report Highlights

NPE Lawsuits on the Rise

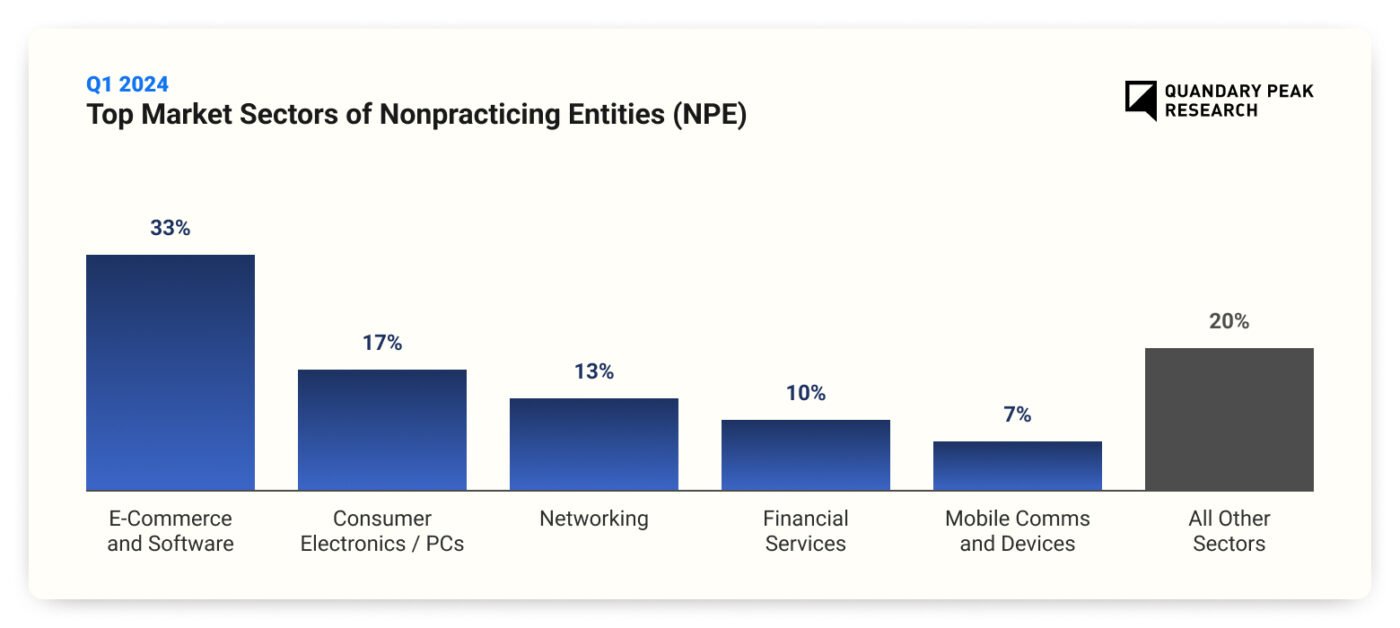

Patent lawsuits filed in the U.S. by NPEs have risen by 24% in the first quarter of 2024 compared to the same period last year. NPEs are firms that hold patents with no intention of practicing their patents, and instead focus on earning licensing fees. A closer look at the numbers reveal NPEs filed lawsuits against 420 defendants in Q1 2024, almost a hundred more than the amount of defendants sued in Q1 2023. This increase is more impressive considering the first quarter of 2023 was down 35% from 2022.

The E-Commerce and Software market sector was most susceptible to NPE-focused litigation in the first quarter, seeing 33% of all defendants added. The second highest market was Consumer Electronics and PCs (17%), followed by Networking (13%), Financial Services (10%) and Mobile Communications and Devices (7%).

Slowed Activity in Delaware

Delaware, the former top venue for patent litigation, has become a less favorable environment for NPEs as the U.S. District Judge Colm Connolly continues to push for transparency with stringent disclosure requirements focused on ownership information and third-party funding.

Procedural Changes in Western Texas

The Western District of Texas changed its rules on case assignments, resulting in a steady decline of NPE patent litigation in the division. As of July 2022, case assignments are randomly assigned to district judges. However, subsequent lawsuits concerning the same patents and parties will be assigned to the judge who oversaw the prior litigation.

Texas is the New Arena for E-Commerce and Software Patents

Experts at Quandary Peak Research have extensive experience consulting on software patent lawsuits brought in Eastern and Western Districts of Texas and more broadly in many jurisdictions in the United States. Contact us today to recruit a software expert witness for your case.